OR SPD IC Pay Stub 2007-2026 free printable template

Show details

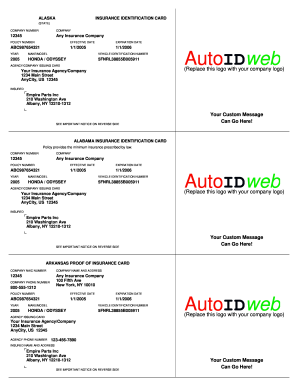

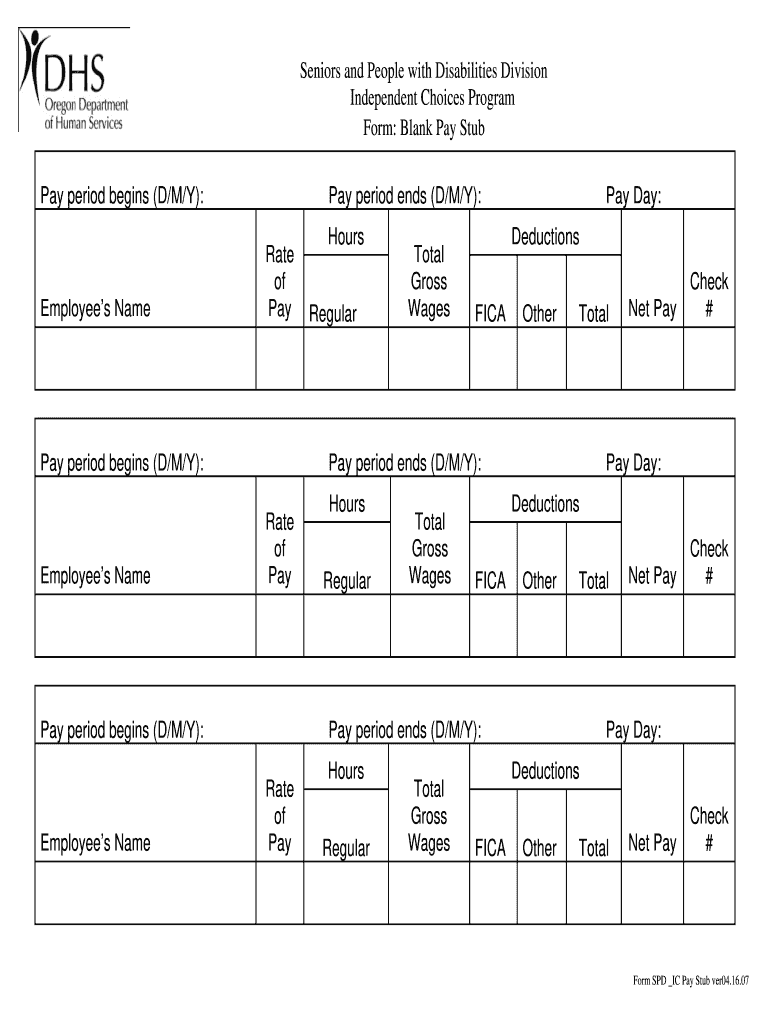

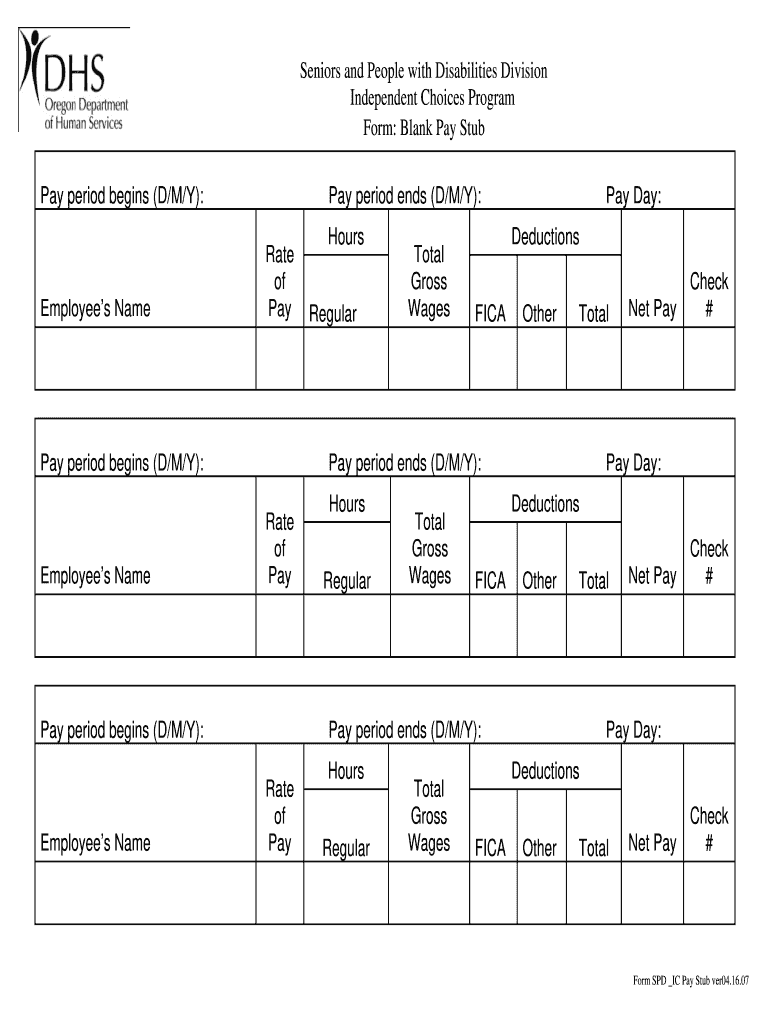

Seniors and People with Disabilities Division Independent Choices Program Form Blank Pay Stub Pay period begins D/M/Y Employee s Name Pay period ends D/M/Y Rate of Pay Regular Total Gross Wages Deductions FICA Other Hours Pay Day Check Net Pay Form SPD IC Pay Stub ver04.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign fillable pay stub pdf form

Edit your fillable pay stub template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pay stub template with calculator no watermark form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing editable pdf blank pay stubs template online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit key features of the spd understand their earnings and deductions form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pay stub generator with calculator form

How to fill out OR SPD IC Pay Stub

01

Obtain the OR SPD IC Pay Stub form from your employer or download it from the official website.

02

Fill in your personal information in the designated fields, including your name, address, and Social Security number.

03

Enter your employee identification number, if applicable.

04

Indicate the pay period for which you are filling out the stub.

05

Record your total hours worked during the pay period in the hours section.

06

Calculate your gross earnings based on your hourly wage or salary, and input this amount in the earnings section.

07

Deduct any withholdings, such as taxes and other deductions, and list these amounts accurately.

08

Calculate your net pay by subtracting total deductions from your gross earnings.

09

Verify that all information is accurate and complete before submitting the form to your employer.

Who needs OR SPD IC Pay Stub?

01

Employees who receive income through an hourly wage or salary.

02

Individuals applying for benefits that require proof of income.

03

Tax filers who need documentation of their earnings for tax purposes.

04

Employers required to provide pay stubs for record-keeping and compliance.

Fill

blank pay stub template

: Try Risk Free

People Also Ask about fillable paycheck stub

How do I make a paycheck stub in Word?

How it works Open the check stub template and follow the instructions. Easily sign the pay stub template word with your finger. Send filled & signed make a paystub or save.

What happens if you use pay stubs?

You could also be setting yourself up for a serious legal issue. There are fines that could total more than $1 million and you could even face jail time. It's probably not worth it to create a pay stub, especially to defraud a financial institution.

Does Microsoft have a pay stub template?

Templates for payroll stub can be used to give your employees their pay stubs in both manual and electronic formats. Free Microsoft Excel payroll templates and timesheet templates are the most cost-effective means for meeting your back office needs.

Can you pay stubs?

Paystubs are easy to generate These pay stubs look legitimate and are nearly indistinguishable from a real pay stub. Scammers can enter any information they want to fraudulently qualify for a rental, opening up the property to risk – financially and reputationally.

Do pay stubs have watermarks?

Most legitimate paystubs will have a watermark. If the document you are looking at does not have a watermark, then it is likely that it is .

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find fillable pay stub?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific pdf filler pay stub and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit stub creator com online?

The editing procedure is simple with pdfFiller. Open your pdffiller paystub in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an eSignature for the blank pay stub in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your pay stub maker with calculator directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is OR SPD IC Pay Stub?

The OR SPD IC Pay Stub is a document used in Oregon that provides employees with a detailed breakdown of their earnings and deductions for a specific pay period.

Who is required to file OR SPD IC Pay Stub?

Employers in Oregon who pay employees are required to provide an OR SPD IC Pay Stub to each employee for their earnings.

How to fill out OR SPD IC Pay Stub?

To fill out the OR SPD IC Pay Stub, employers must include the employee's name, pay period dates, total hours worked, gross wages, deductions, and net pay.

What is the purpose of OR SPD IC Pay Stub?

The purpose of the OR SPD IC Pay Stub is to inform employees about their earnings, deductions, and net pay, ensuring transparency in payroll processes.

What information must be reported on OR SPD IC Pay Stub?

The OR SPD IC Pay Stub must report the employee's name, pay period, hours worked, gross income, various deductions (like taxes and benefits), and net pay.

Fill out your OR SPD IC Pay Stub online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Check Stub Maker With Calculator is not the form you're looking for?Search for another form here.

Keywords relevant to blank pay stubs

Related to blank paystub

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.